Webtel.mobis System Brings the Worlds 2 Billion Unbanked Persons And Global Cash Use Into a Global Digital Economy

ST PETER PORT, Guernsey and NEW YORK, Oct. 12, 2021 (GLOBE NEWSWIRE) -- Global Telephony Provider Webtel.mobi (WM) has spent years perfecting and optimizing its TUV Global Digital Currency and its Global Clearing System. Its structuring and refinements included facilitating the inclusion of all the worlds Unbanked Persons and Cash Payments into its ecosystem as described below:

Situation

Cash

All current planning for a Global Digital Economy or a Global Cashless Society is based on flawed assumptions that the usage of Cash is declining, and the use of Digital Money is increasing. These assumptions are wrong. Cash usage is increasing globally and has been doing so, year-on-year, for the past decade. This includes the usage of Cash in Developing and Developed countries. On average, 50% of all transactions, worldwide, are carried out with Cash. No planning for Cashless Societies or Digital Economies has taken this into account because echo-chamber discussion on these matters presuppose that the entire world functions in the same manner as high-tech cities in Developed Countries but it does not. Part of the Cash market uses Cash due to choice, and part of it uses Cash because the persons are Unbanked. Cash Payments and the use of Cash represent the largest single market-sector in the world (see the Resources section at the end of this article).

Unbanked Persons

Part of the market utilizing Cash are the +/- 2 Billion persons in the Unbanked Sector worldwide. This sector represents people who do not have bank accounts either because of the lack of infrastructure in countries, lack of banks in rural areas, lack of access to reach physical banks from rural areas, lack of online banking facilities, the cost of maintaining bank accounts and of transfers and payment, and the lack of KYC documentation.

Causes

The reasons for the predominance of Cash usage internationally are due to two factors, choice, and force of circumstance:

Choice (due to a variety of reasons, including):

- The cost of opening and maintaining Bank Accounts

- The costs of Digital Payments

- The multiple varieties of fraud possible in Digital and Card Payments

- Chargebacks to Merchants

- Late settlement to Merchants and high retention fees to Merchants

Force of circumstance (due to a variety of reasons, including):

- Lack of Identity Documents / Utility Bills / other documents to satisfy KYC Requirements

- The cost of opening and maintaining Bank Accounts

- The costs of Digital Payments

- Lack of national infrastructure for people to reach towns or cities to access Banks

- Lack of Banking Infrastructure

- Lack of Support Infrastructure for Online Payment problems

- Lack of Infrastructure for ATM placement (for conversion of Digital to Cash when needed)

- Inability of current systems to render digital payments as instant payouts to Merchants

- Inability of current systems to provide conversion between all currencies

- Inability of Mobile Apps to function on Pre-Smart Mobile Phones (50% of Phones in use)

- Inability of Image-Rich and Dynamic (high bandwidth) websites and Mobile Apps to be used in high-cost internet / high-cost mobile data / slow bandwidth countries

Consequences

If using the erroneous views and planning to date, it will not be possible for a Digital Economy to be implemented worldwide, in a unified and standardized manner. If it cannot be implemented in a unified way worldwide, it cannot be implemented at all.

The largest single market-sector in the world by transaction value Cash Payments remains a fragmented market sector of 164 different currencies in 197 different countries (245 if including Territories), with no single company providing a unified global service with unified standards to this largest and potentially most valuable single market-sector in the world by transaction value.

The largest single market-sector in the world by sector the +/- 2 Billion Unbanked Persons in the world are ignored, and continue to labor under adverse circumstances. Those working as Migrant Workers have to remit funds while losing large percentages of their salaries in currency conversion fees and transfer costs. Others experience the dangers of carrying or keeping Cash, and are denied access to the advantages of the 21st Century Digital Economy being de-facto Second-Class Digital Citizens.

How WM resolved all of these issues

During its nine years of fully operational testing and refinement worldwide, WM specifically structured its Global Financial System to cater for full inclusion of the Global Cash market and Global Unbanked Sector including in-situ studies and research in Developing countries among Unbanked communities.

Not only has it resolved all of the issues, its system that resolved all the issues is fully tested, proven, due diligenced and fully-operational worldwide. It has resolved all the issues regarding both Cash Payments and Unbanked Persons even eradicating the concept of Banked and Unbanked consolidated the worlds Cash usage into one unified system with global standards, as follows:

Substitute KYC

WM developed a Substitute KYC Documentation system that facilitates a full and satisfactory KYC process for persons without Identification Documents, Utility Bills, and other forms of Personal or address identification. This has been so successful that these Substitute KYC Documents are used by their holders for a variety of non-WM activities too as they are accepted by other parties independent of WM (see the Resources section of this article for an example of WMs Substitute KYC Documents).

Enhanced AML Procedures

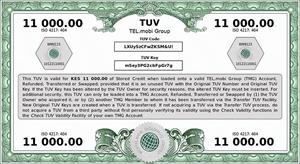

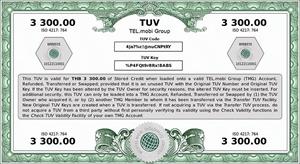

WM itself does not accept Cash. Persons using Cash to acquire TUV Digital Currency obtain it from WMs VSMP Affiliates and Independent Agents, who have in advance transferred funds (Stored Credit) to WM for the value of the TUV Digital Currency that they issue. There are advanced AML processes for the acquisition of TUV Digital Currency using Cash including limits on amounts, frequency, and other tested forms of effective AML before, during, and after the acquisition of TUV Digital Currency for Cash.

Best of Both regarding Digital Money and Cash

WMs TUV Digital Currency incorporated all the best characteristics of Cash (instant and simultaneous payment and receipt, zero transaction cost, 24/7/364 usability) with the best of Digital (secure storage, secure transfer, global reach, low currency conversion rates, AML, etc). WM also removed the negative aspects of both forms of currency (potential for counterfeiting, fraud, chargebacks, money laundering, etc)

Global distribution and accessibility

WMs Online Platform is compressed, simplified, and optimized for use by all Smart Phones and Pre-Smart Mobile phones, including in high-cost internet / high-cost mobile data / slow bandwidth countries including by the 75% of people on expensive prepaid contracts worldwide, and the 50% of Pre-Smart Mobile Phones worldwide. It is therefore deliverable, accessible by, and usable by all persons in all countries.

SCRM Machines and TUV Redemptions for Unbanked persons

For Unbanked persons to redeem TUV Digital Currency back to Cash, WM has developed its own kiosk for Stored Credit refund withdrawals the Stored Credit Refund machine or SCRM. It is being rolled out in 2022. They are centrally controlled by WM, and are subject to the same security and other standards. They also have limitations on withdrawal amounts conformant with global regulatory standards. They also have mobile and battery-operated versions for remote area placement or access. WM also has a TUV Redemption Process where accredited WM VSMP Affiliates and Independent Agents can redeem TUVs for Cash subject to stringent KYC and AML processes.

Non-interference with Money Supply, Monetary Policy or Currency Sovereignty

WM does not create or issue currency. It converts currency already issued by Central Banks into Digital Format, using the TUV as a vehicle. The funds (Stored Credit) remain in a regulated bank account for the life of the TUV. Stored Credit is not a payment, part-payment, or deposit, and remains the property of the owner (and therefore of the country of origin) until redeemed by the owner. As such, no exchange control regulations are contravened because the Stored Credit funds remain the property of the owner and issuing country until repatriated. In fact, if owners convert their Stored Credit, this has the effect of de-facto raising the issuing countrys foreign exchange reserves.

Zero Cost

Acquisition, Payments, Transfers, Splitting, Consolidation and Redemption of WMs TUVs are at zero cost.

Through these tested, proven and fully operational structures and processes worldwide, WM has successfully resolved the entry of Unbanked persons and the cash economy into the 21st Century Digital Economy, and made it possible for a real and practical Global Digital Economy to exist.

The Global and Unified Digital Economy does not have to be waited for or striven for. With the WM System, it already exists.

Resources:

Media Contact:

Nick Lambert: wm@thoburns.com

G45 World Cash Report Headline Facts:

https://www.g4scashreport.com/top-facts

G45 2018 World Cash Report:

https://www.g4scashreport.com/-/media/g4s/cash-report/files/2018-world-cash-report---english.ashx?la=en&hash=0F3BECD46B4820D7FA32112E99252AAB

Congressional Research Service Cash Usage in the USA:

https://sgp.fas.org/crs/misc/R45716.pdf

Deutsche Welle Cash Use in Germany:

https://www.dw.com/en/times-change-but-german-obsession-with-cash-endures/a-43718626

McKinsey and Co Number of Unbanked Persons Worldwide:

https://www.mckinsey.com/industries/financial-services/our-insights/counting-the-worlds-unbanked

Wikipedia Number of Unbanked Persons in the USA:

https://en.wikipedia.org/wiki/Unbanked#The_unbanked_in_the_United_States

WSBI Number of Unbanked Persons in the European Union:

https://www.wsbi-esbg.org/press/latest-news/Pages/Close-to-40-million-EU-citizens-outside-banking-mainstream.aspx

WM Substitute KYC Document:

https://webtel.mobi/static/pdf/Personal_KYC_Substitute_Document.pdf

Research Reports on the Capacities of the WM System:

https://tinyurl.com/TUVresearch

Video on the Capacities of the WM System:

https://youtu.be/XYBrCikUhn8

WMs urls:

https://webtel.mobi/pc (Tablets / Laptops / Desktops)

https://webtel.mobi (Smart Phones)

https://webtel.mobi/wap (Pre-Smart Mobile Phones)

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/31777266-792a-4ada-9405-f03136f769c3

https://www.globenewswire.com/NewsRoom/AttachmentNg/cd27d45e-ccef-44a5-9439-cc17df013bb7

Photos are also available at Newscom, www.newscom.com, and via AP PhotoExpress