TORONTO, July 23, 2018 (GLOBE NEWSWIRE) -- Vision Capital Corporation ("Vision") is pleased to announce that June 30, 2018 marked the 10-year anniversary since the inception of the Vision Opportunity Funds (the "Vision Funds").

|

|

Vision Opportunity Fund LP Class A vs. Major Indices (Total Return & CAGR) Performance Record from July 1, 2008 - June 30, 2018 |

|

|

|

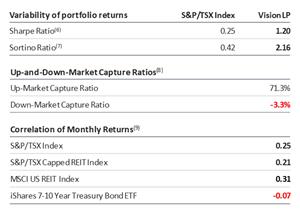

Risk Metrics |

|

|

Over the past decade the unique combination and expertise of its three portfolio managers, whose collective experience in property markets and real estate securities spans nearly 100 years, has been focused on investing in the real estate sector through investments in publicly-traded equity and debt securities. Vision's strategy of targeting the purchase of real estate cheaper in the stock market than the property market, and shorting overvalued real estate securities, has resulted in the Vision Funds delivering superior risk-adjusted total returns for its clients.

Vision is pleased to report that over this 10-year period the Vision Opportunity Fund LP (A) returned 274%1 net of all fees and expenses. This represents a compounded annual growth rate of approximately 14.1%1.

A chart accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/bcf3f035-3dc7-44c2-a4b6-361edbd654f6 Of equal importance to Vision is the protection of its clients' capital and the particular focus on achieving compelling risk-adjusted total returns. Vision's achievement of this goal is further reflected by:

- The Vision Funds, over the 10-year period, delivering total positive returns for all full calendar years and rolling 12-month periods while, in the same period, there have been one or more full calendar years during which the S&P/TSX Capped REIT, the S&P/TSX Composite and the MSCI U.S. REIT Indices have each delivered negative total returns.

- The Vision Funds achieving a negative down-market capture ratio over the 10-year period, which indicates that over the past 10 years during months when the broad stock market index2 returns were negative, on average, the Vision Funds delivered positive total returns.

- Strong total returns were achieved with low correlation to both the broad stock market index2 and the REIT indices3, and a negative correlation to the bond index4.

A table accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/7a51f0e7-857f-4430-bb02-48bb7c664d8e

The superior performance of the

Vision Funds has been recognized by S&P Capital IQ, Scotiabank, Morningstar and the Canadian Hedge Fund Awards with twelve industry awards and honours over the past decade.

Vision thanks all of its clients, business partners and dedicated employees for their incredible support over the past 10 years and looks forward to providing its clients with superior risk-adjusted total returns for many years to come.

Please click here for a "

Snapshot" profile of the Vision Opportunity Funds.

For information on the Vision Opportunity Funds, please contact Darren Kosack, Senior Vice President of Sales and Marketing at

kosack@visioncap.ca, or directly at 416.569.8498, and Gary Hagen at

hagen@visioncap.ca, or directly at 416.369.9307. For more information on Vision, please visit

www.visioncap.ca.

Notes: (1) Past performance is not indicative of future performance (2) The S&P/TSX Composite Total Return Index. (3) Refers to the MSCI U.S. REIT Total Return Index and the S&P/TSX Capped REIT Total Return Index (4) The iShares 7-10 Year Treasury Bond ETF seeks investment results that correspond generally to the price and yield performance of the intermediate-term sector of the U.S. Treasury market as defined by the Barclays Capital 7-10 Year Treasury Index. (5) All performance and risk metric references to the Vision Opportunity Fund LP (or Vision LP) herein refer to Series 1 of the Class A Units of the Vision Opportunity Fund LP. The inception of the Vision Opportunity Fund Limited Partnership was July 1, 2008. (6) The Sharpe ratio measures the return in excess of the risk-free rate relative to the volatility of the return. The higher the Sharpe ratio, the better returns the fund has yielded in relation to its risk. (7) The Sortino ratio is a variation of the Sharpe ratio which differentiates harmful volatility from volatility in general by replacing standard deviation with downside deviation in the denominator. A higher Sortino ratio indicates a lower risk of large losses occurring. (8) Up-Market and Down-Market Capture Ratios are statistical measures of an investment manager's overall performance in up and down markets, respectively. The ratios are used to evaluate how well an investment manager performed relative to an index during periods when that index has risen or fallen. A negative Down-Market Capture Ratio indicates that the fund increased on average during the months when the index decreased. (9) The correlation figures presented are the correlation coefficient of monthly total net returns comparing the Vision Opportunity Fund LP A vs. the stated index over the last 5 years.